<< Zpět do Vzdělávacího centra

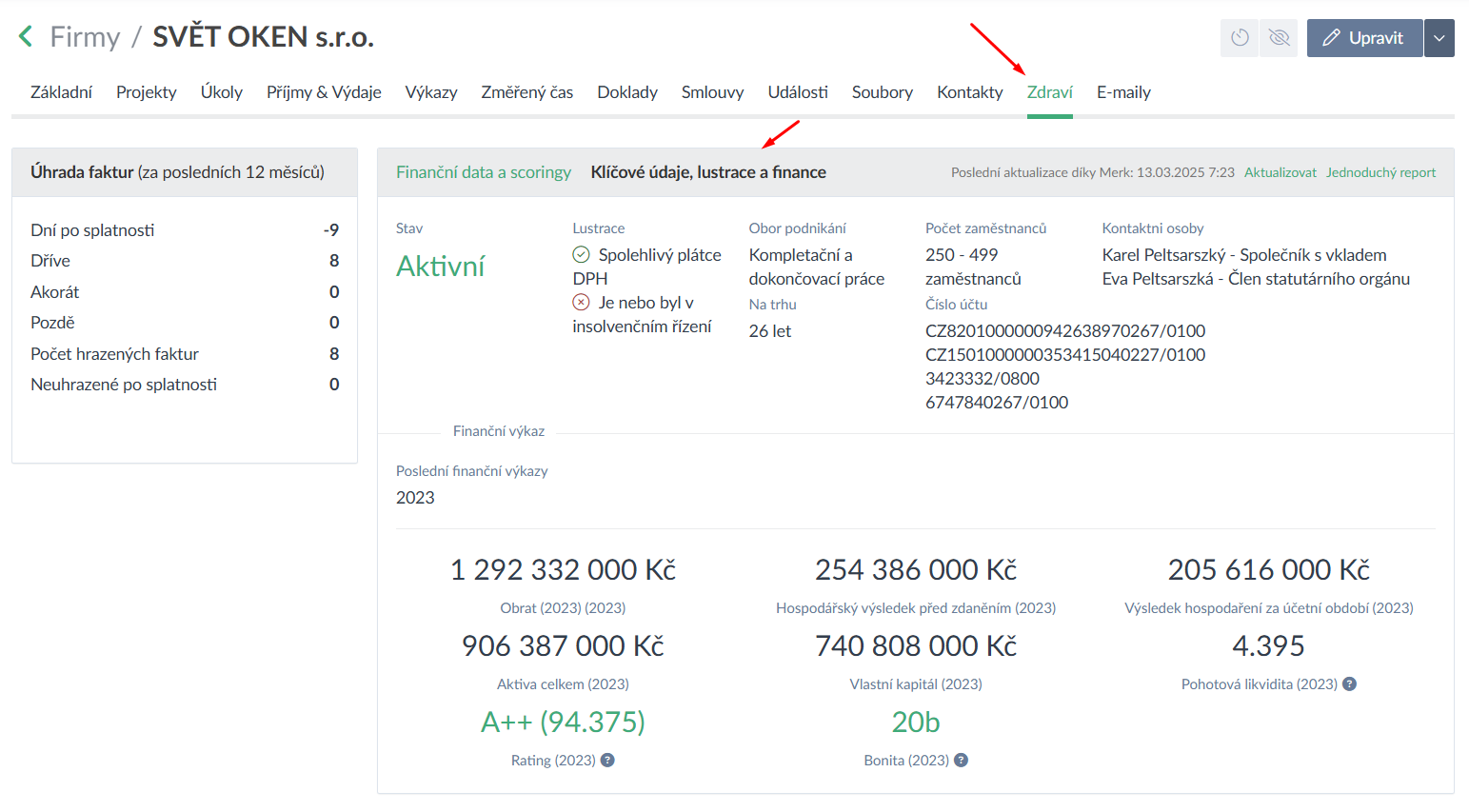

V sekci Zdraví firmy lze zobrazit finanční reporty vašich obchodních partnerů, zákazníků či dodavatelů, v sekci Klíčové údaje, lustrace a finance.

Získáte tak objektivní informace o ekonomické důvěryhodnosti a bonitě vašich obchodních partnerů.

Jde o funkci poskytovanou naším partnerem Merk. K získání informací o firmě je zapotřebí, aby firma měla vyplněné IČ a měla sídlo v Česku nebo Slovensku.

Postup získání finančních dat:

- U zvolené firmy jděte do přehledu Zdraví firmy

- Systém vyhledá zvolenou firmu v databázi subjektů - podle IČ se sídlem v ČR nebo SR

- Ihned se vám zobrazí finanční data a scoringy

Co je dobré vědět:

- Finanční data firemních subjektů se vyhledávají dle IČ

- Za tyto data nic navíc neplatíte (u účtů Kapr, Delfín, Žralok)

- Data jsou získávána z různých zdrojů, jejich kompletnost a aktuálnost může být různá. Caflou pro daný firemní subjekt z Česka a Slovenska zobrazuje údaje poskytnuté partnerem (Merk).

Jaká data jsou v reportech k dispozici:

- Stav - zda firma nadále podniká nebo je její činnost ukončena

- Aktivní

- Neaktivní (zpravidla zaniklé subjekty)

- Lustrace - základní informace o finanční spolehlivosti

- Spolehlivý plátce DPH

- Není a nebyl v insolvenčním řízení

- Bez dluhu na VZP (pro slovenské firmy)

- Obor podnikání - popis obchodních aktivit

- Na trhu - délka působení firmy

- Počet zaměstnanců

- Číslo účtu

- Kontaktní osoby - společníci, jednatelé, vlastníci, statutární orgány atp.

Finanční výkaz

- Obrat - celkový objem peněžních prostředků, které projdou firmou za určité časové období. Tento ukazatel je důležitý pro pochopení, jak efektivně firma generuje příjmy a jak rychle se peníze v systému otáčejí.

- Aktiva celkem - kombinovaná hodnota oběžných aktiv a dlouhodobých aktiv celkem pro nejnovější finanční údaje. Zahrnuje tedy veškerý majetek, který organizace používá, bez ohledu na způsob jeho financování.

- Rating

- A+++ (Excelentní) >=95

- A++ (Výborný nadprůměr) >=92

- A+ (Výborný) >=85

- A (Velmi dobrý) >=75

- B (Lepší průměr) >=60

- C (Průměr) >=50

- D (Slabší průměr) >=45

- E (Hluboký podprůměr) >=35

- FX (Nevyhovující) <35

- N (Nezjištěno)

- Hospodářský výsledek před zdaněním - zisk před zdaněním zveřejněný v posledních finančních údajích, který bude odrážet odpočty všech provozních a neprovozních nákladů

- Vlastní kapitál - součet veškerého kapitálu a rezerv za poslední finanční období. Jinak se označuje jako fondy akcionářů nebo vlastní kapitál

- Bonita - patří do skupiny predikčních modelů. Nazývá se též indikátor bonity (Bi) a pracuje se šesti ukazateli. Čím větší hodnotu Bi dostaneme, tím je finanční situace hodnocení firmy lepší. Přesnější závěry si lze porovnat s touto stupnicí:

- extrémně zlá (-3 až -2)

- velmi zlá (-2 až -1)

- zlá (-1 až 0)

- určité problémy (0 až 1)

- dobrá (1 až 2)

- velmi dobrá (2 až 3)

- extrémně dobrá (více než 3)

- Výsledek hospodaření za účetní období

- Pohotová likvidita - vypovídá o schopnosti podniku hradit právě splatné dluhy (krátkodobé závazky) hotovostí (tj. hotovost, peníze na bankovním účtu, KD CP). Interval doporučených hodnot <0,2 - 0,6>

Úhrada faktur (za posledních 12 měsíců)

Přehled zobrazuje platební morálku vašeho odběratele za posledních 12 měsíců, tedy zda platí firma za faktury včas či se zpožděním.

Report zobrazuje následující informace:

- Dní po splatnosti - v průměru kolik dní po splatnosti jsou faktury hrazeny, záporná hodnota značí, že jsou faktury placeny před splatností

- Dříve - kolik faktur bylo zaplaceno před splatností

- Akorát - kolik faktur bylo zaplaceno v den splatnosti

- Pozdě - kolik faktur bylo zaplaceno po splatnosti

- Počet hrazených faktur - kolik faktur je ve "vzorku"

- Neuhrazené po splatnosti - kolik faktur je aktuálně neuhrazeno po splatnosti